About Us

Civics Group: 09S101

School: Meridian Junior College

Economics Tutor: Mdm Yati

Links

Meridian Junior College

MJC ISIS

MJC IVLE

09S101

09S101@WindowsLive

Tagboard

Archives

April 2009

May 2009

February 2010

Demand

Ads

Wednesday, May 6, 2009

Public Goods and Merit Goods

In a free market economy goods and services will only be provided if firms can ensure they will receive payment for them. They will then provide whatever quantity is the most profitable. In doing this, they take account only of the costs and benefits to them. If there are external costs or benefits, they will not take account of these. This may mean that they don't provide the socially optimal level of output. Public goods and merit goods are goods that would either not be provided at all or would not be provided in sufficient quantity, for these reasons.

Public goods

Public goods are goods that would not be provided in a free market system, because firms would not be able to adequately charge for them. This situation arises because public goods have two particular characteristics. They are:

- Non-excludable - once the goods are provided, it is not possible to exclude people from using them even if they haven't paid. This allows 'free-riders' to consume the good without paying.

- Non-rival - this means that consumption of the goods by one person does not diminish the amount available for the next person.

We can see this if we look at the case of street lights. If a street light is provided by a firm, then it cannot exclude people from benefiting from it. It is not possible to charge people who walk under it. When people walk under it, it is also true that they don't make it go dimmer - they don't diminish the amount available for the next person. Street lights are therefore non-excludable and non-rival - they are public goods.

Merit goods

Merit goods are goods that would be provided in a free market system, but would almost certainly be under-provided. Take the case of education. If there were no state education provided at all, there would still be private schools for those who could afford them, and indeed many new private schools might open. However, there would not be nearly enough education provided for everyone to benefit. This happens because the market only takes account of the private costs and benefits. It does not take account of the external benefits that may arise to society from everyone being educated. For this reason, merit goods will be under-provided by the market.

If the private sector won't provide these goods in sufficient quantity, then the only way more will be provided is either if the government encourages firms to produce more (perhaps by subsidising the good or service) or if provides them itself. A significant proportion of government expenditure arises from the government providing merit goods. The main examples are:

- Education

- Health

- Fire service

Sarthak Rastogi :)

2 comment(s)

Sunday, April 26, 2009

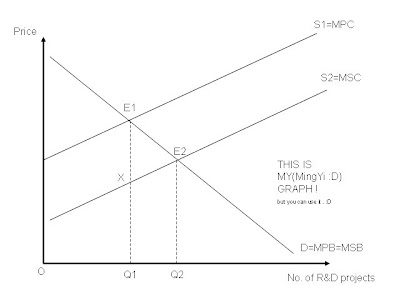

R&D is whereby a firm researches to develop new products of higher quality. Other firms will thus, benefit from the improvements of these new products, enjoying lower costs from higher efficiencies (this is an external benefit). This would mean that the all firms (both those that do R&D and don't) would benefit the same since the improvements of technology would be the same. This is why Marginal Social Benefit (MSB) is equals to Marginal Private Benefit (MPB). However, since the firms that undertake R&D have to use more resources to research and develop while the firms that don't undetake R&D don't have to use any resources, the Marginal Private Cost (MPC) would be larger than the Marginal Social Cost (MSC). Hence, the divergence in the cost curves. Since firms are unwilling to undertake R&D due to its high costs and that firms are able to wait for other firms to develop, there will be less firms undertaking R&D, resulting in an underproduction of research activities. Hence, R&D activities are an external benefit in production.

The graph above shows that MPC is greater than MSC. The point at which the firms maximise profits is when MPC is equals to MPB, which is at E1. The firms are thus producing an output of OQ1. This is smaller than the socially efficient output of OQ2where MSB is equals to MSC. There is thus an underproduction of Q1Q2 and it results in a welfare loss of the area E1E2X. This unequal allocation of resources is thus, a market failure.

The graph above shows that MPC is greater than MSC. The point at which the firms maximise profits is when MPC is equals to MPB, which is at E1. The firms are thus producing an output of OQ1. This is smaller than the socially efficient output of OQ2where MSB is equals to MSC. There is thus an underproduction of Q1Q2 and it results in a welfare loss of the area E1E2X. This unequal allocation of resources is thus, a market failure.The Singapore government is spending more on R&D so that producers would be given an incentive to increase R&D projects. The increase in spendings by the Singapore government will shift the S1 curve towards the right, making the output that is produced closer to the socially efficient output. This reduces the welfare loss and the area E1E2X will become smaller. Thus, the government is increasing its spending on R&D projects.

Suggest reasons why the government has increased R&D expenditure gradually.

Well, if the government increased R&D expenditure too quickly, there may be a presence of over-subsidies and even more firms would undertake R&D. This could result in the overproduction of R&D, resulting in another market failure. By increasing the R&D gradually, slowly but surely, the government would be able to obtain the socially efficient output and correct this market failure. The exact expenditure that should be spent on R&D is very difficult to monetize, thus it is better to be safe than sorry. :D

Responding to Jun Hao's answer...

R&D is not a public good because the firms that do not undertake R&D will also have to pay for the new and improved products to use them. This means that R&D is excludable and only those who have the money to pay for it will be able to use it. Thus, it is not a public good. However, if the firms do not have to pay for these new products and if every single firm will be able to use these products, then it can be considered as a public good since it would be non-excludable and non-rivalrous. So yeah . . .

Hurry and finish your PIs guys !

MINGYI :D

Labels: Merit, Research and Development

0 comment(s)

Saturday, April 25, 2009

R&D generates external benefits in production. It can be considered a public good as it is non-excludable (assuming there is no patent filed or firms wait for patents to expire, on average 20 years later, before using the technology) and non-rivalrous. Public goods face the free rider problem which results in a missing market because producers are unwilling to supply the good as consumers can choose not to pay for it, based on the assumption that consumers are rational beings. (Very much applicable to Singaporeans who love all things free, why pay if it is not compulsory?)

Many private firms do not undertake R&D due to the free rider problem, they would rather wait for other firms to spend money to develop better technologies then 'steal' their newly developed technology. Our government realised that less R&D is taking place so they increased funding for firms to undertake R&D because R&D has external benefits in production so successful R&D would increase productive efficiency of not just one but many firms and bring more revenue to Singapore whereas without R&D our economy would remain stagnant. The government's main duty is to look after welfare of Singaporeans and by promoting R&D it is indirectly fulfilling its responsibility.

Suggest reasons why the government has increased R&D expenditure gradually.

Because... haste makes waste... Another reason is that the government wants to establish a stable R&D sector first before it is willing to pump more money into it. This is just my opinion.

Jun Hao

ADDENDUM:

Just to add a bit to JunHao's excellent answer: Another reason why the government may be slow in increasing the amount of R&D spending is because of the indeterminate nature of the payoff. We all know that R&D produces a positive externality, but what we don't know is the magnitude of this external benefit. Furthermore, not all R&D would yield a definite benefit; some research never produce any fruits at all. This only further muddles the situation. If the government subsidises too much, it may risk an over-allocation of resources, which is equally undesirable to society as an under-allocation of resources toward R&D. Hence, the government may want to increase expenditure at a gradual pace to ensure no over-subsidising occurs.

Also, the money from the subsidies would have to come from — you guessed it — taxpayers. To fund the subsidies the government must increase the amount of tax, which creates a disincentive for people to work and invest. This would, of course, have an adverse effect on economic growth. In order to circumvent this problem, the government hence gradually increases the expenditure of subsidies as this would allow more time for the money needed to be collected without a sharp spike in tax rates.

~Nicky(:

Labels: Merit, Research and Development

1 comment(s)